Bank of England base rate

9 hours agoThe Bank of England BoE base rate is often called the interest rate or Bank Rate and sets the level of interest all other banks charge. HMRC interest rates are linked to the Bank of England base rate.

Visual Summary Inflation Report August 2019 Bank Of England

The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn.

. Then in August 2018 the Bank of England raised the bank base rate from 05 to 075 as the economic outlook improved. The base rate influences the interest rates that many lenders charge for mortgages loans and other types of credit they offer people. The base rate is the rate at which commercial banks grant loans to the public.

If youd like to move your mortgage to a different interest rate you have 2 options. Bank of England Museum. A vote next week to hike again by 025 percent would see it.

17The Bank of England has increased base rates to 075 from 05 after the Monetary Policy Committee MPC voted in favour of a rise. 29We offer a range of fixed rate mortgages that let you fix your rate and payments for a set period. Its part of the Monetary Policy action we take to meet the target that the Government sets us to keep inflation low and.

This base rate is also referred to as the bank rate or Bank of England base. 16The Bank of England has increased base rates to 025 from 01 after the Monetary Policy Committee MPC voted in favour of the first rise in more than three years. 18The Bank of England Monetary Policy Committee voted on 17 March 2022 to increase the Bank of England base rate to 075 from 050.

Your rate may also change if your current deal ends. 4At its meeting ending on 16 March 2022 the MPC voted by a majority of 8-1 to increase Bank Rate by 025 percentage points to 075. 16Bank Rate is the single most important interest rate in the UK.

When the base rate is lowered banks. Decisions regarding the level of the interest rate are made by the monetary policy committee MPC. 10What is Base Rate.

Its the rate the Bank of England charges other banks and other lenders when they borrow money and its currently 075. One member preferred to maintain Bank Rate at 05. To receive advice on the most suitable first.

The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn. It is the base rate of interest for the UK economy and has a strong impact on the short and long-term interest rates charged by commercial banks. 29What is the base rate.

Banks operate as an intermediary accepting deposits from savers and lending funds to borrowers. 17The Bank of England followed through with a widely anticipated interest rate hike on Thursday as it attempts to tackle soaring inflation which it. 70 Current inflation rate Target 20.

30The Bank of England Base Rate BOEBR also known as the official bank rate is the rate of interest charged by the BoE to commercial banks for overnight loans. 27The Bank has already carried out three consecutive interest rate hikes taking the base rate back to pre-pandemic levels of 075 percent. It is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1 day.

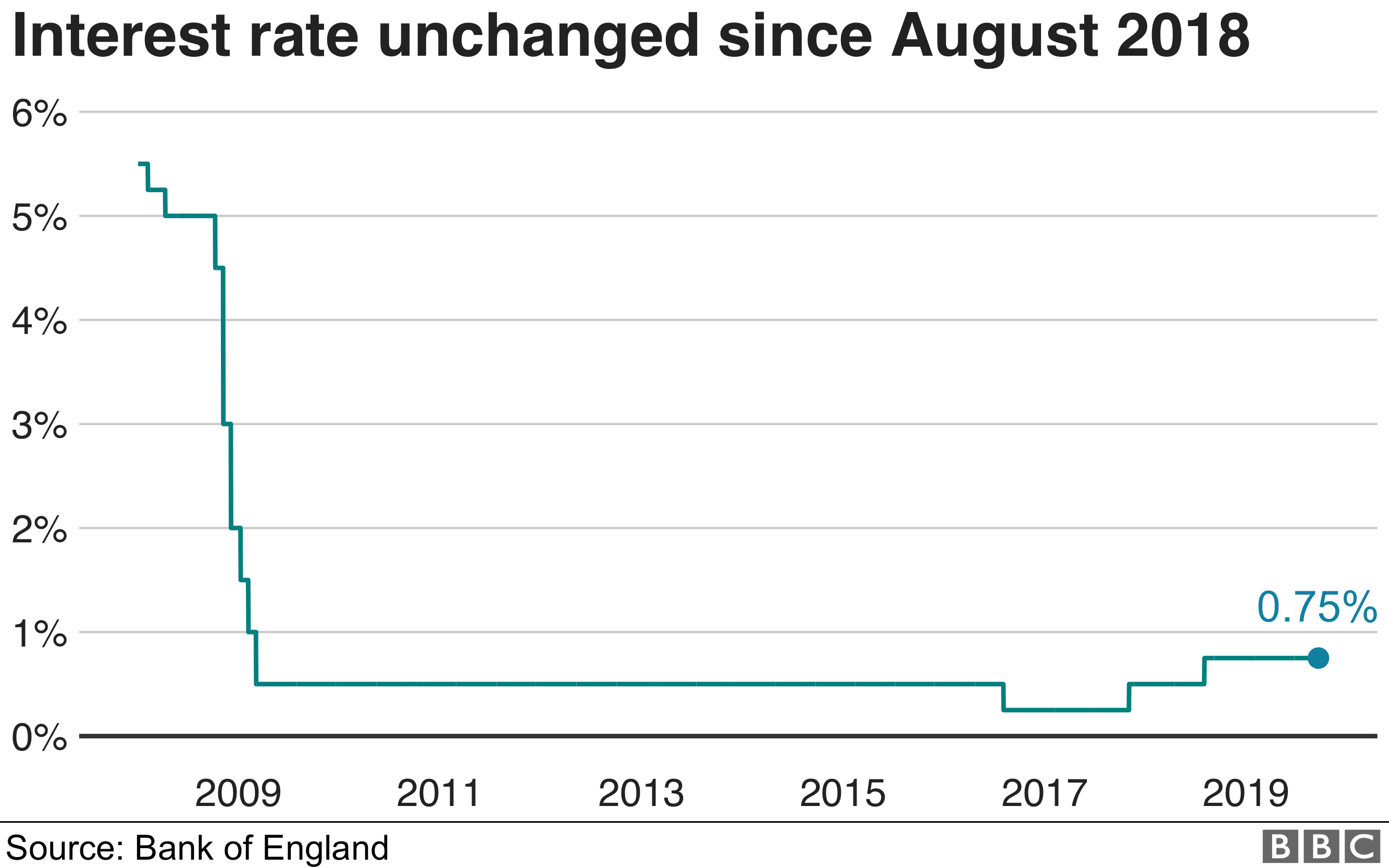

47 rows The Bank of England base rate is the UKs most influential interest rate and its official. Their profits are derived from the spread between the rate they pay for funds and the rate they receive from borrowers and. Our Monetary Policy Committee MPC sets Bank Rate.

Includes the Base Rate increase to 075 in March 2022 and MPC meeting dates for 2022. 14The Bank of England finally raised interest rates in November 2017 for the first time in over a decade back to 05. Our use of cookies.

16The Bank of Englands Monetary Policy Committee meets every month to determine what needs to be done to its official bank rate to manage the economy. If the central bank raises the rate you might find that your finances are impacted. Our mission is to deliver monetary and financial stability for the people of the United Kingdom.

Interest is a fee you pay for borrowing money and is what banks pay you for. Threadneedle Street London EC2R 8AH. For example our rates often rise and fall in line with the.

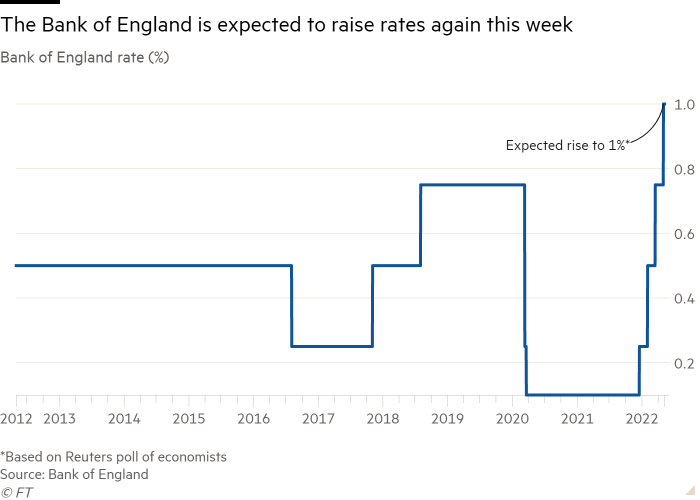

In the MPCs central projections in the February Monetary Policy Report published before Russias invasion of Ukraine UK GDP growth was expected to slow. The Bank of England BoE base rate which will be reviewed on Thursday May 5 impacts high street bank interest rates. 29The Bank of England BoE is the UKs central bank.

On certain products our interest rates are linked to the Banks Base Rate which is influenced by changes in the Bank of England Base Rate. The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn. 17The Bank of England has upped the base rate for the third time since December as it attempts to keep a lid on soaring inflation.

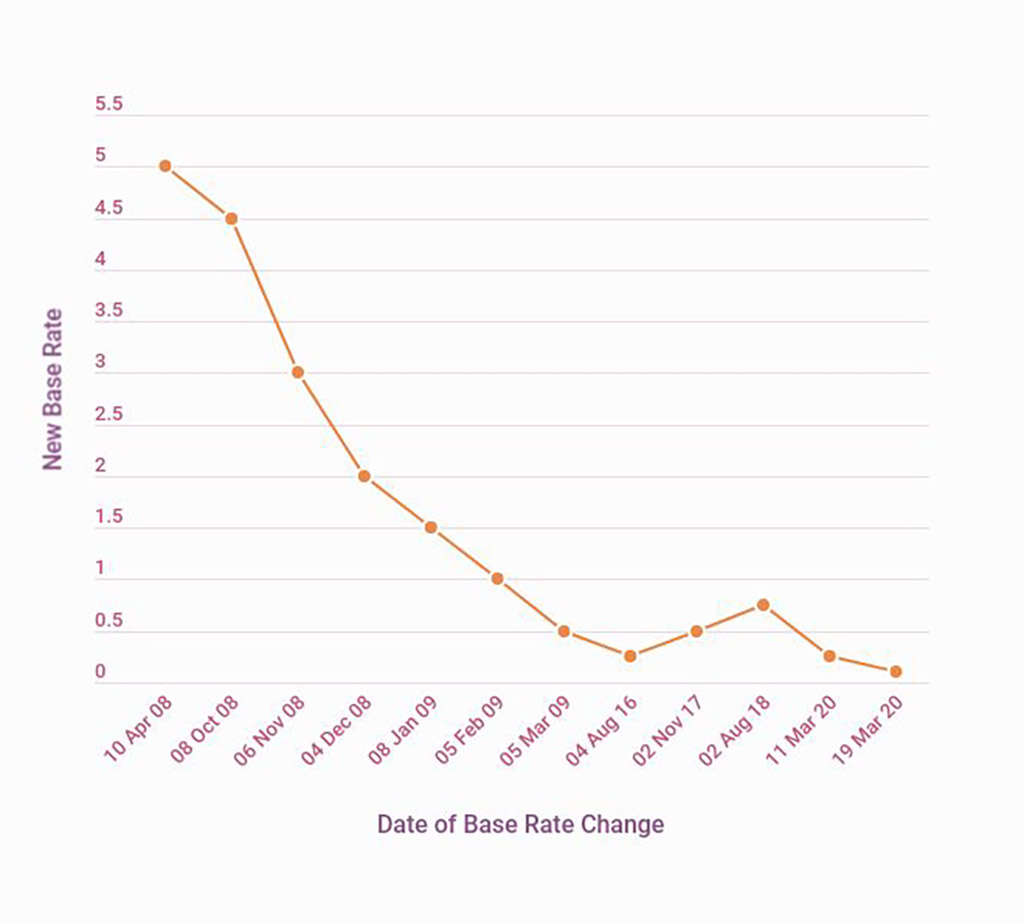

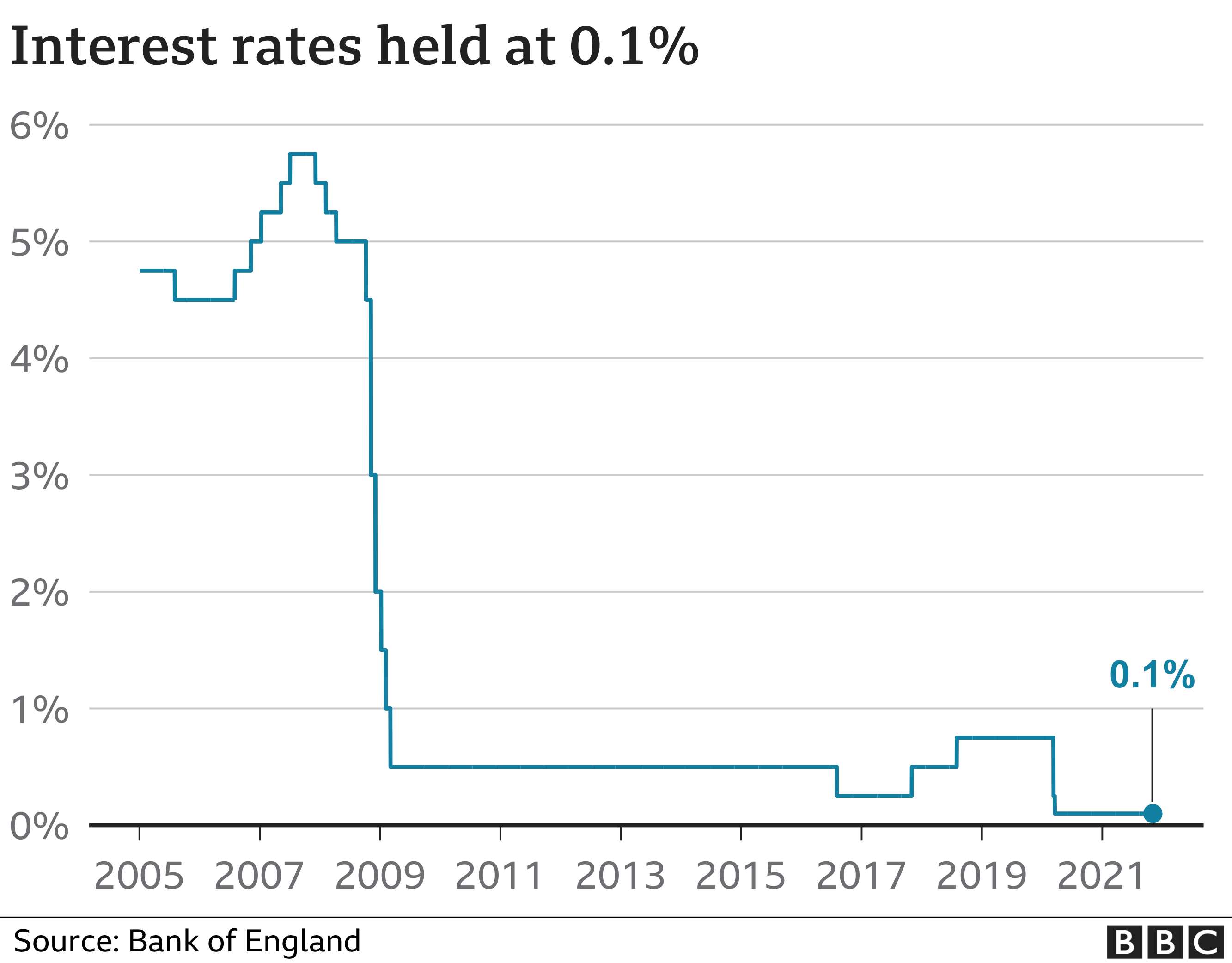

The Base rate should not be below the Bank rate. 17On 2 August 2018 the Bank of England base rate was increased to 075 but then cut to 025 on 11 March 2020 and shortly thereafter to an all-time low of 01 on 19 March as emergency measures during the COVID-19 pandemic. 3The Bank of England BoE base rate which will be reviewed on Thursday May 5 impacts high street bank interest rates.

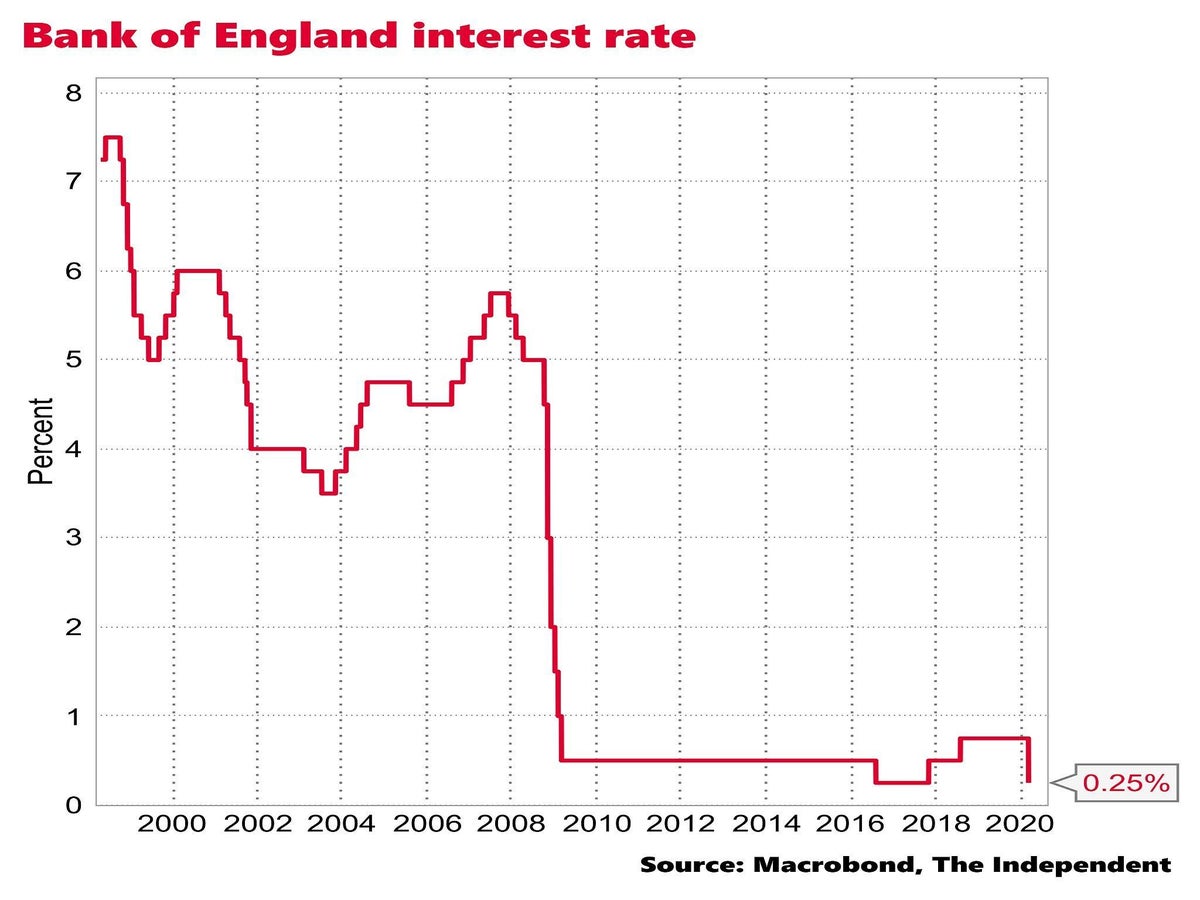

Interest is a fee you pay for borrowing money and is what banks pay you for. The official bank rate has existed in various forms since 1694 and has ranged from 01 to 17. If the Bank of England base rate changes during your fixed rate period it wont affect your payments.

In the news its sometimes called the Bank of England base rate or even just the interest rate. This page shows the current and historic values of. 28Discover what the current Bank of England base rate is when the next Bank of England MPC meeting is when the interest rate could increase how the base rate can affect your mortgage and how it is affected by Brexit and coronavirus.

Dates for Monetary Policy Committee MPC announcements on Bank Rate and publication of MPC meeting minutes and the quarterly Monetary Policy Report. 3THE BANK of England will make a decision on whether to hike interest rates this week. 3The Bank of England has increased base rates to 05 from 025 after the Monetary Policy Committee MPC voted in favour of a rise.

Bank Of England Base Rate Money Co Uk

Bank Of England Hints At Future Interest Rate Rise Bbc News

Bank Of England Poised To Raise Interest Rates To Pre Covid Level Financial Times

How The Bank Of England Set Interest Rates Economics Help

Why Have Interest Rates Been Slashed And What Will The Impact Be The Independent The Independent

Bank Of England Forecasts Low Interest Rates For Longer Bbc News

Comments

Post a Comment